What is Tax system in India- Taxes in India can be categorized as direct and indirect taxes. Direct tax is a tax you pay on your income directly to the government. Indirect tax is a tax that somebody else collects on your behalf and pays to the government e.g. restaurants, theatres etc. recover taxes from you on goods you purchase or a service you avail. This tax is, in turn, passed down to the government.

Direct Taxes are levied on income, wealth and profit. Direct taxes include income tax, inheritance tax, national insurance contributions, capital gains tax, and corporation tax (a tax on company profits). The burden of a direct tax cannot be passed on.

Indirect taxes take many forms like Goods and Services tax (GST) on restaurant bills and movie tickets. The burden of indirect tax can be passed on. Goods and services tax, which has recently been introduced is a unified tax that has replaced all the indirect taxes that business owners have to deal with.

There are various heads of Income under Direct Tax which are written below:

| Head of Income | Nature of Income covered |

| Income from Salary | Income from salary and pension |

| Income from Other Sources | Income from savings bank account interest, fixed deposits, winning game shows |

| Income from House Property | Income from Rental |

| Income from Capital Gains | Income from sale of a capital asset such as mutual funds, shares, house property |

| Income from Business and Profession | Income from Business and Profession |

Taxpayers in India, for the purpose of income tax includes:

- Individuals, Hindu Undivided Family (HUF), Association of Persons (AOP) and Body of Individuals (BOI)

- Firms

- Companies

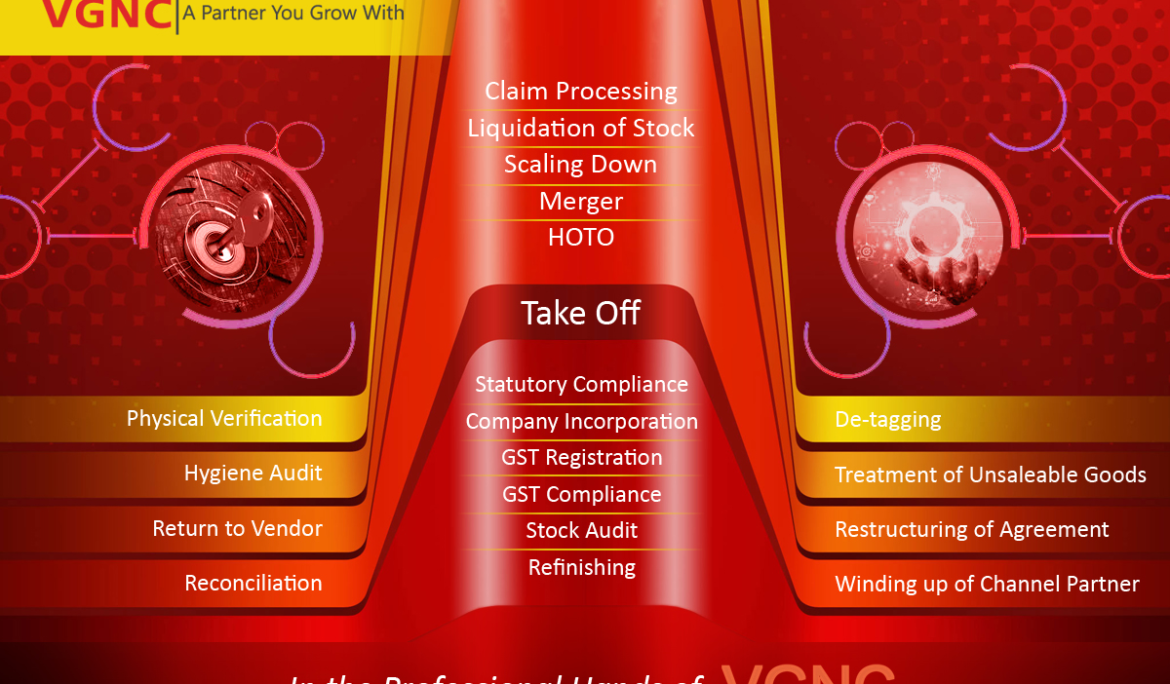

Compliance Service in Taxes

- Income tax Compliance

- GST Compliance